Will APAC brands decrease media budget in 2023?

share on

About 29.3% of brands globally plan to decrease their media budget next year, with the same number saying they will invest more in 2023. Four in 10 brands globally will maintain their budgets at 2022 levels. On a regional level, only 14.7% of brands in APAC said they will decrease their media budget while 50% said they will maintain 2022 budget in the new year. Slightly over a third (35%) in APAC plan to slightly increase their media budget for 2023.

By contrast, a third of respondents in EMEA agree that there could be a significant (more than 10%) or slight decrease (0% to 10%) in media budget next year, compared to 30% who are planning a slight increase in spend. These statistics are according to a new study from the World Federation of Advertisers (WFA) and Ebiquity which assessed the intentions of 43 multinational companies. The sample included five of the world’s top 10 advertisers by spend, which collectively invest more than US$44 billion in advertising.

According to the study, 74% of the respondents "agree strongly” or “agree” that 2023 budgets are influenced by the recession, with marketers required to justify investment. Only 2% strongly disagreed while 17% remained neutral. The big change in behaviour seen in the research is a different emphasis on the way that money will be allocated next year, with greater emphasis on short-term, performance marketing. In fact, 28% will seek to boost performance, compared to 21% who are focused on increased brand spend in 2023.

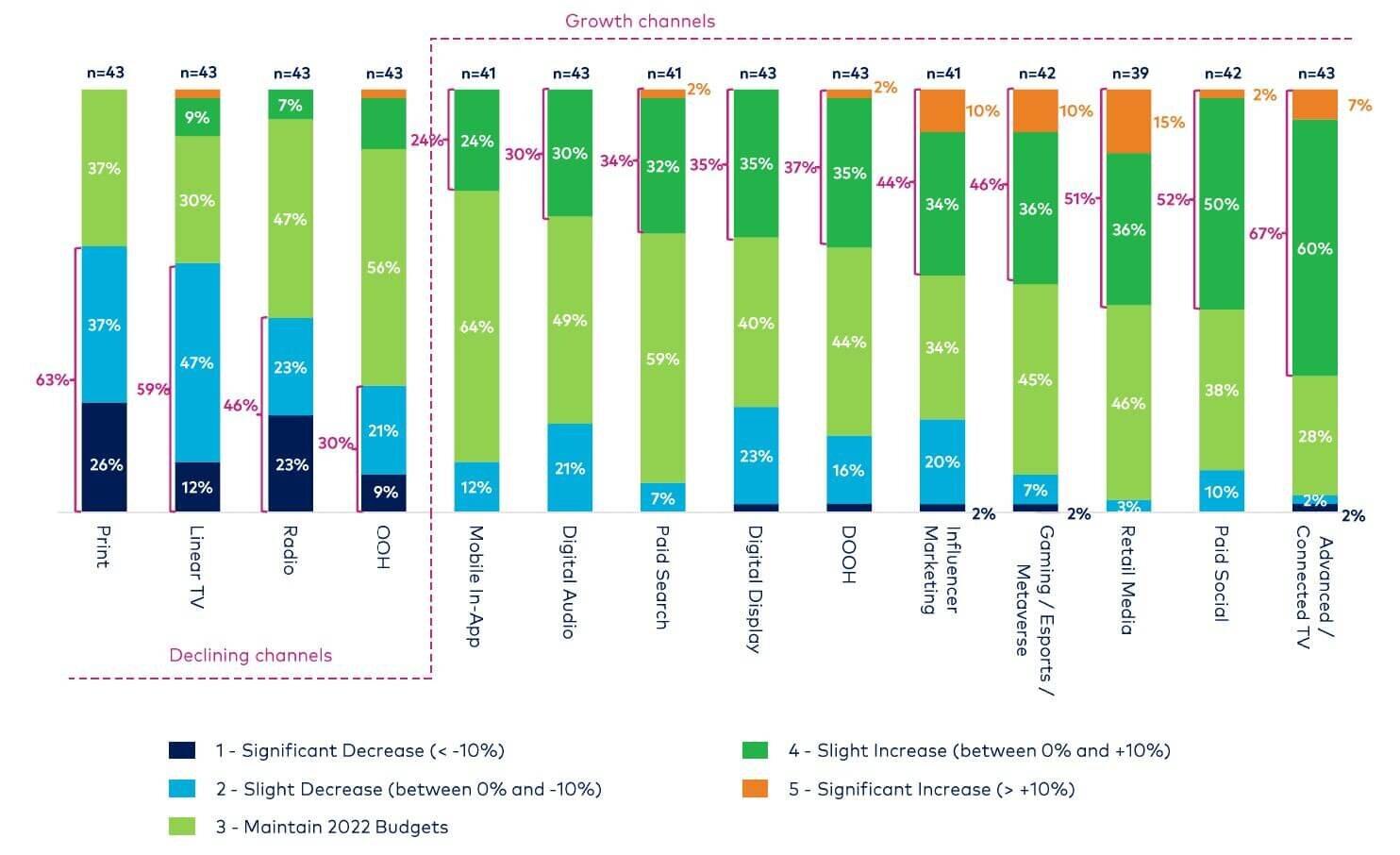

Digital media is predicted to see an increase in investment, with 42.0% of respondents indicating they will increase spend either slightly or significantly. The digital channel that is expected to see significant increase in investment is CTV (67%) followed by paid social (52%) and retail media (51%). On the other hand, offline media such as TV, radio, print, and outdoor are predicted to suffer, with 48.8% of respondents planning to cut offline investment and a quarter are looking to make a significant cut (of more than 10%) in print spend.

The study also found greater flexibility in investment as 40% of respondents will increase their share of flexible/biddable buys next year. Meanwhile, 51% will maintain the 2022 mix. According to WFA and Ebiquity, this strategy allows brands to hold back funds, should the economic conditions dictate. Fewer than one in 10 respondents (9%) are planning to increase the proportion of budget allocated to upfront commitments.

WFA CEO Stephan Loerke said it is encouraging to see that a number of clients are planning on standing firm and taking heed of the well-taught lessons of previous recessions, which show time and again that those who continue to invest or increase their ad spend emerge stronger from periods of economic uncertainty.

Meanwhile, Ebiquity CEO Nick Waters said as brands are required to achieve more with less next year to optimise the value of their investments, it makes sense to review expenditure and cut ineffective and wasteful spend first. "Sustaining investment is one thing, but there is a risk to long-term brand health by over-investing at the bottom of the purchase funnel. It is a natural instinct to want to see immediate results from media investment but the longer-term trade off needs to be weighed carefully. It becomes more expensive to re-build brand credentials once they have slipped," Waters added.

Digital Marketing Asia is back for its 10th year! 10 years of exclusive insights, experience sharing and great success stories. Join us for three days of hyper-focused presentation topics across six tracks on 15 - 17 November and connect with 1000+ of the world's brightest minds in the marketing world to learn and upscale from 85+ speakers from the hottest regional and global brands. Click here to register now!

Related articles:

9 key areas from Malaysia's Budget 2023 for biz leaders to keep an eye on

Study: 60% of CMOs to cut marketing analytics team by 2023

Country breakdown: Which ad mediums are expected to grow in 2023?

Study: By 2023 APAC's physical activity market is set to dominate at US$373.5 billion

WhatsApp needs to be in your 2023 marketing mix, but please get it right

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window