Global CMOs want single agency model, local marketers disagree

share on

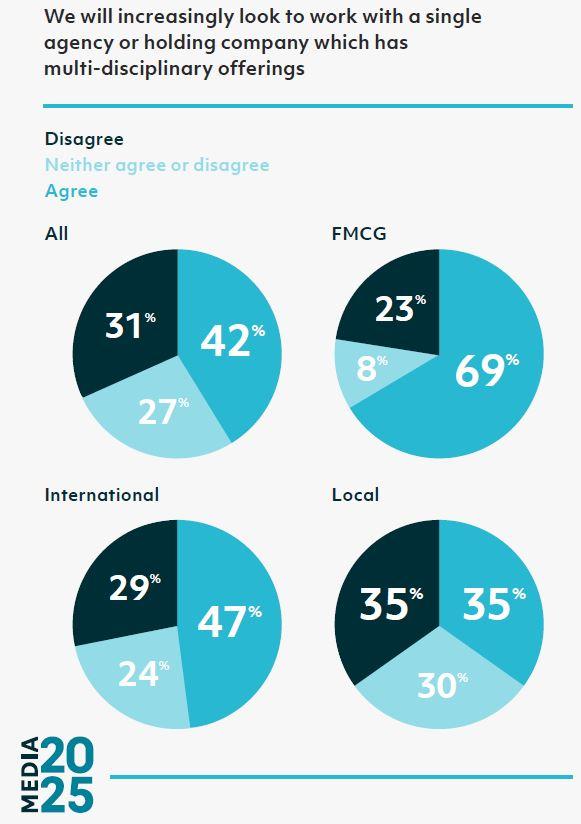

The majority of global CMOs (77%) are either planning or undergoing a transformation of their external agency model. Only 12% have completed the transformation of their external agency model. According to the Media 2025 research by MediaSense, close to half of global CMOs (42%) are searching for a single agency or holding company to service their needs.

The majority of respondents from FMCG companies (69%) and those with international responsibilities (47%) were in favour of looking to work with a single agency or holding company with multi-disciplinary offerings while 23% disagreed.

Meanwhile, marketers with local responsibilities were split with 35% agreeing on single agency structure, while the other 35% disagreed. The rest remained neutral.

Media 2025 surveyed 100+ global marketers consisting of CMOs and directors and provides a barometer for current thinking around the state of the media ecosystem. According to the research, media agencies have been fighting the ongoing threat of in-housing paid media and identified areas for growth such as eCommerce, tech reselling and content.

According to the study,

In-housing is apparently much less of an issue for agencies now because some clients underestimated the continuous investment required to sustain in-housing.

As a result, the out-housing is starting to happen, the research said. The majority of clients would want to retain control and have full visibility on agency resourcing, activations and fees, enabling their agencies to manage the talent and tech, as well as using a more diverse set of tech partners. According to MediaSense, these clients will bring measurement and attribution in-house if they haven't done so already.

Interestingly, 58% of respondents said media is perceived as a strategic investment in their organisation rather than a cost. The number was higher for those with local responsibilities (70%) compared to those with international responsibilities (50%).

Areas agencies have leverage in

Most of the brands that have completed their digital transformation internally plan to do more media planning in-house (64%) and use agencies primarily for execution. At the same time, these companies also plan to bring more media functions in-house (55%). On the contrary, 42% of respondents, in general, do not plan to move media planning in-house.

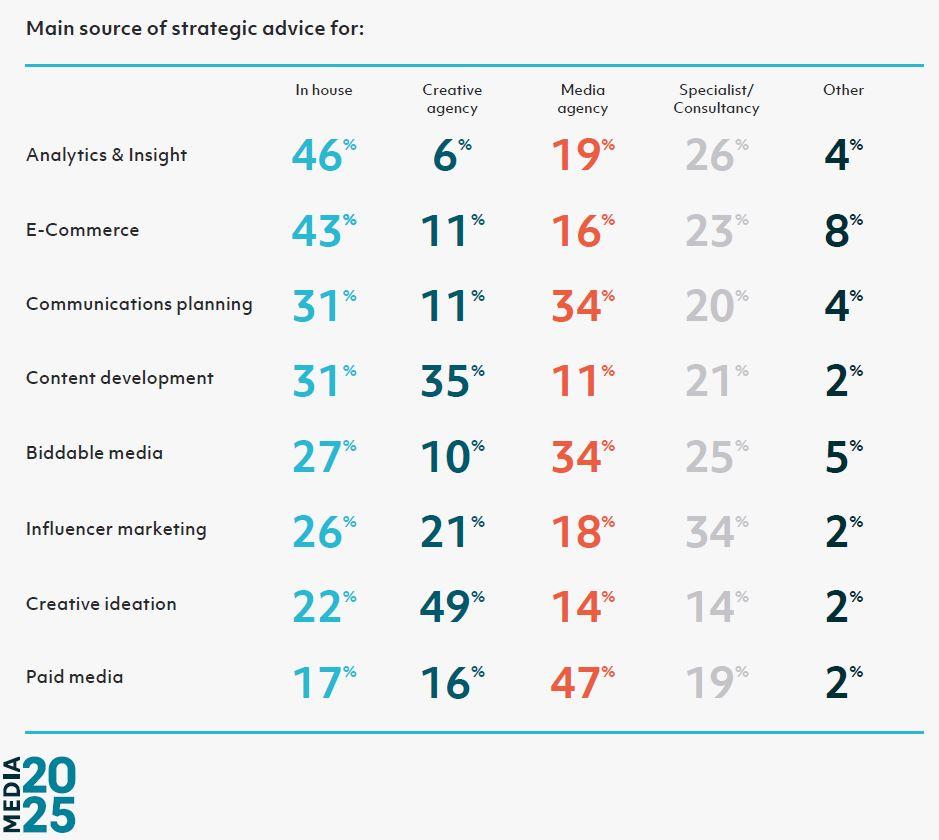

In fact, most respondents still turn to media agencies for advice on paid media (47%) and a significant number do so for biddable media (34%) and communications planning (34%) too. With eCommerce booming at the moment, this is definitely a growth area for media agencies to build up their expertise in.

According to MediaSense, this is then set to become another key battleground between the specialist and media agencies, as well as the digital and advertising holding companies, especially since eCommerce goes through mobile, social, programmatic, search, and connected TV.

The top five areas that marketers usually turn to in-house teams for are analytics and insight (46%), eCommerce advice (43%), communications planning (31%), content development (31%), and biddable media (27%).

Brands still in the midst of digital transformation

Only 11% of global CMOs are confident that they have completed their digital transformation journey. On the other end of the spectrum, 7% indicated that they have no plans for digital transformation. Meanwhile, the majority of brands (82%) are planning or in the midst of transforming their internal media operating model.

According to the research, brands should take the time to reassess whether they are suitably equipped - internally and externally - to deliver the transformation they require. Starting with a clear goal and evaluation framework is crucial to ensure focus and create momentum.

Some of the drivers highlighted include in-housing, with 55% expecting to bring more functions in house and talent, with 56% believing a skills shortage is holding the industry back. COVID-19 shedding was one of the main reasons for driving scarcity of talent, as respondents said that the initial right-sizing was not fully replaced. Digital transformation was also a challenge for finding talent due to the unanticipated eCommerce growth. Firms also realised that graduate hiring was not adequately prioritised, which also led to the issue.

Worrying signs for cross-media measurement

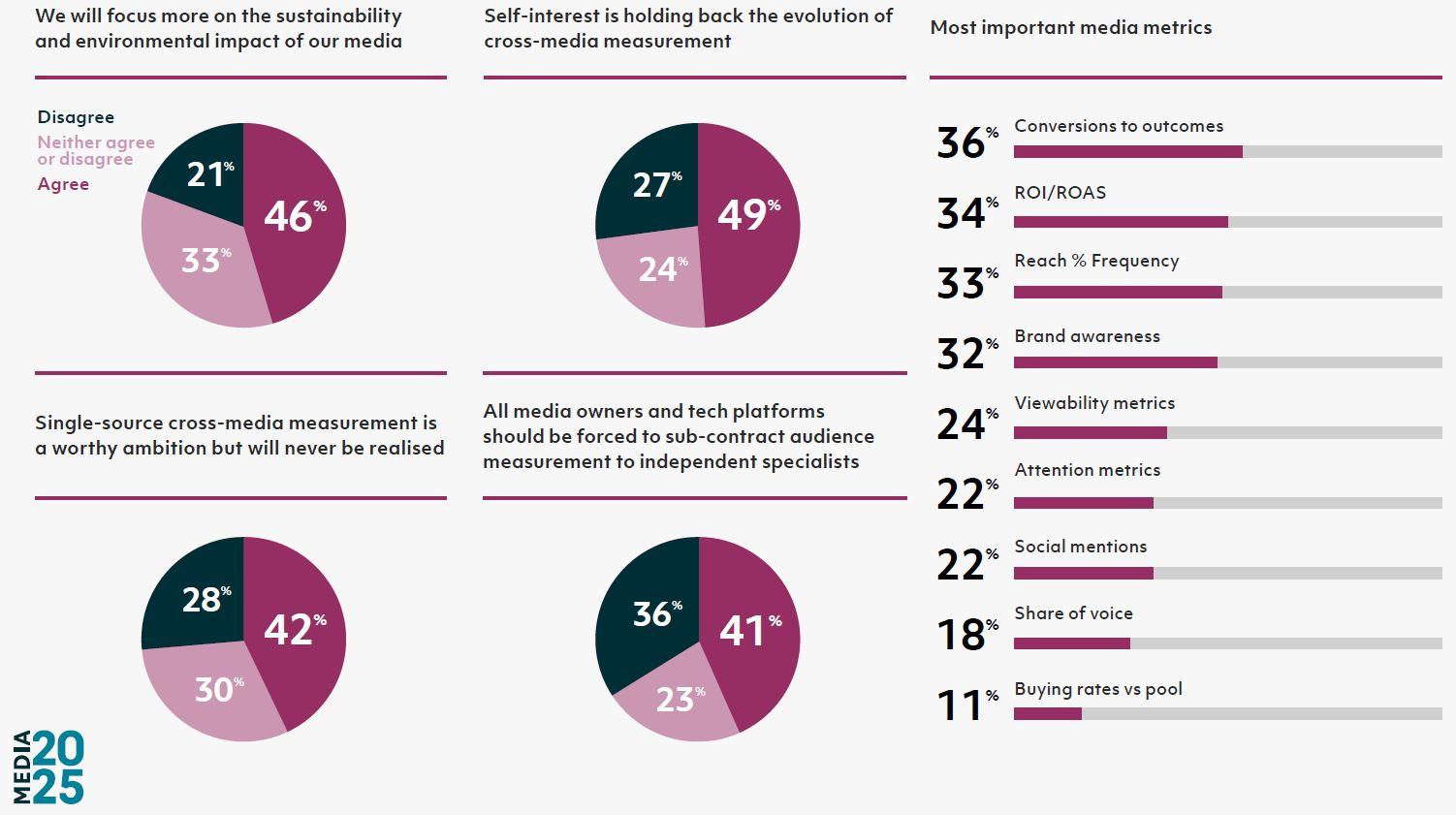

While brands are focused on finding a better balance between brand and performance marketing, there are worrying signs for the future of cross-media measurement, with 42% believing the ambition will never be realised with a higher proportion (49%) citing self-interest as a key limiting factor. Attention is likely to pivot towards sustainability and measuring the environmental impact of media, with 46% planning to focus more on this area.

Nonetheless, the top three most important priorities for marketers now are ensuring brand safety online (30%), improving cross media measurement and attribution (23%), and addressing digital measurement in a post-cookie world (22%).

MediaSense's managing partner, Ryan Kangisser, said the level of transformation occurring is a promising sign for the future of the industry, as brands and agencies seek to better equip their organisations to become more agile, integrated and consumer-centric.

"COVID-19 has nevertheless had a profound impact through (for many) an unanticipated growth of eCommerce, which has exposed acute gaps across talent and measurement. Now is the time for greater cross-industry collaboration and leadership to find solutions which better support this constantly evolving and converging ecosystem," he added.

Photo courtesy: 123RF

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window