Study: More brands spend over 30% of budget on influencer marketing

share on

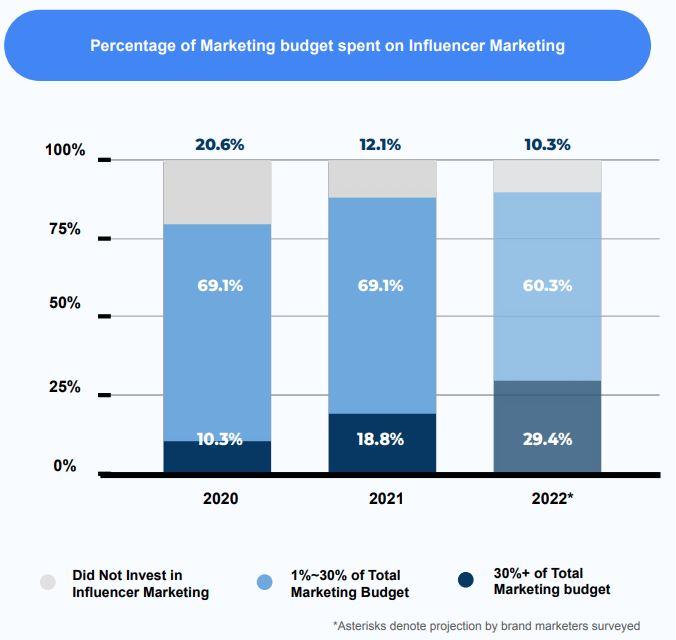

The number of brands spending more than 30% of their total marketing budget on influencer marketing has increased to 25.4% this year, up from 21.4% in 2021. Meanwhile, 69.4% of brands are spending 1% to 30% of their total marketing budget on influencer marketing, according to The Southeast Asia Influencer Marketing Industry report by influencer marketing and commerce platform Partipost and Quest Ventures. The report surveyed consumers in Singapore, Indonesia, and Taiwan, the three countries where Partipost first set foot and built its presence in Southeast Asia.

Although a significant portion of brands in Singapore (78%) still spend up to 30% of their total marketing budget on influencer marketing, there was a 4.8% increase to 16.9% from last year for those who spend more than 30% of their budget. Meanwhile, the percentage of brands that did not try influencer marketing decreased from 16.9% in 2020 to about 5.1% this year.

Like Singapore, Indonesia also saw an increase in marketing spend for influencer marketing, especially those dedicating at least 30% of their marketing budget for this segment.

Meanwhile, Instagram (71.4%) was ranked the most popular social media platform across the three countries, followed by TikTok (15.8%), YouTube (6%), and Facebook (5.2%). This was also the same for Singapore and Indonesia. Meanwhile, Instagram and YouTube were the top two most popular social media platforms.

In general, influencer campaigns are usually used on a campaign basis to generate buzz. However, Partipost said more brands are planning always-on influencer campaigns to create a longtail of share of voice, launching new campaigns on a monthly or bi-monthly basis. More brands are also working with at least 11 to 100 influencers.

Nano influencers (46%) were found to have the highest impact on consumers when it came to buying decisions. They are more effective at impacting buying decisions since they usually come from the consumers' circle of family and friends. Celebrities (20.6%) also have a significant amount of influencer on consumers, followed by macro influencers (17.7%), and micro influencers (15.7%).

In Singapore, 44.1% of consumers agreed that they are more influenced by family and friends that recommend a product to them many times. Instead of working with many influencers for a one-off campaign, while in Indonesia, 81.4% of brands collaborated with them last year. This was a jump from 52.5% in 2020. Indonesian consumers, in particular, prefer influencer content to brand content as it is relatable (63.7%) and honest (21.7%). Authenticity remains an important factor that makes an influencer genuine and relatable for their followers, as followers view them as more "human" instead of a distant public figure.

While nano influencers wield the most influence, other factors also impact buying decisions such as a product being recommended by several influencers within a period of time (32.7%). Meanwhile, a product recommended by an influencer many times (25.1%) also has the ability to influence purchase decisions.

Reviews (30.2%) were a top favourite among consumers on social media across the three countries, followed by tutorials (19.4%), Instagram Highlights (17.1%), and unboxing (13.1%). For Singapore, in particular, reviews (40.2%) and tutorials (20.7%) were also popular, followed by social feed (17.7%) and unboxing (15.5%). Singaporeans mainly use social media to stay connected (79.9%) with current affairs and receive information (71.8%).

Photo courtesy: 123RF

Related articles:

Study: HK advertisers wary about influencer quality in market

Opinion: Will traditional ideals of beauty have any role in the metaverse?

Are virtual influencers less credible than human ones? SEA consumers weigh in

share on

Free newsletter

Get the daily lowdown on Asia's top marketing stories.

We break down the big and messy topics of the day so you're updated on the most important developments in Asia's marketing development – for free.

subscribe now open in new window